Latest News

Check out the latest news from Tudors

Hampton Court Palace Flower Shower

Hampton Court Flower Show is on! 1st- 7th July 2021 RHS flower shows at Hampton Court and Tatton Park given July go-ahead. The RHS says its plans will ensure the events can go ahead safely with social distancing measures if still necessary. Flower shows will go...

Womens Day 8th March 2021

Happy International Women's Day 2021 8th March 2021

We remain open for business

We remain open for business. In line with Government Guidelines we remain open for business following COVID-19 guidelines during the lockdown restrictions. Are opening times are: Mon - Fri 9am - 6pm Sat 9am - 5pm We are continuing to fully comply with Government...

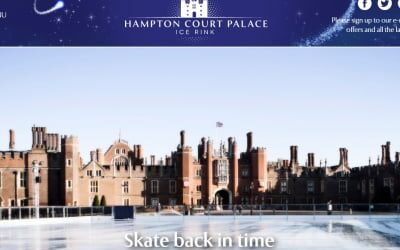

Hampton Court Ice Rink is coming

Prepare to be swept away by the seasonal atmosphere of Hampton Court Palace this Christmas as the stunning ice rink returns for another year. Join Hampton Court Ice Rink to skate against a backdrop of one of the greatest palaces on earth – Henry VIII's historic home,...

Tudor and Co are proud Sponsors of Hurst Park May Fair May 2018 – Saturday 12th May 12pm – 3pm

Tudor and Co are proud Sponsors of Hurst Park May Fair May 2018 - Saturday 12th May 12pm - 3pm http://www.hurst-park.surrey.sch.uk/

Tudor and Co are pleased to receive thank you presents from happy clients

Tudor and Co are pleased to receive thank you presents from happy clients. If you are thinking of selling or letting, please call us for a Free No Obligation market valuation on your home: T. 0208 224 4020 E. sales@tudorandco.co.uk E....

Super Moon over Hampton Court Palace

When to see the supermoon The first supermoon of 2018 peaks at 9:24 p.m. EST (0224 GMT Tuesday Jan. 2). For observers in New York City, the moon will rise in the east-northeastern sky at 4:34 p.m. EST and stay up through the night, setting the morning of Jan. 2...

Metro Newspaper Article on East Molesey

Metro Newspaper Article on East Molesey Wonderful article on living in EAST MOLESEY / HAMPTON COURT. Explaining about whats new to the area, snopping around the history and shops and vital statistics on the area. Very interesting read: Setting the scene EAST MOLESEY...

Skate back in time – Hampton Court Ice Ring

Skate back in time - Hampton Court Ice Ring 24th Nov 2017 - 7th Jan 2018 Taken from Hampton Court website: Prepare to be swept away by the seasonal atmosphere as our stunning ice rink opens to the public for its annual run. Join us to skate against a backdrop of one...

Former Army officer from West Molesey wins Great British Bake Off

Former Army officer from West Molesey wins Great British Bake Off West Molesey stuntwoman Sophie Faldo in the winner of this year's Great British Bake Off.The former Army officer took the title after presenting three varieties of bread for the signature challenge and...

2017 Concours of Elegance at Hampton Court Palace

2017 Concours of Elegance at Hampton Court Palace. A 3 day event featuring, rare cars from September 1st to the 3rd 2017 at the Hampton Court Palace IN BRIEF Concours of Elegance is bringing more than 1000 of the world’s most exclusive cars to Hampton Court...